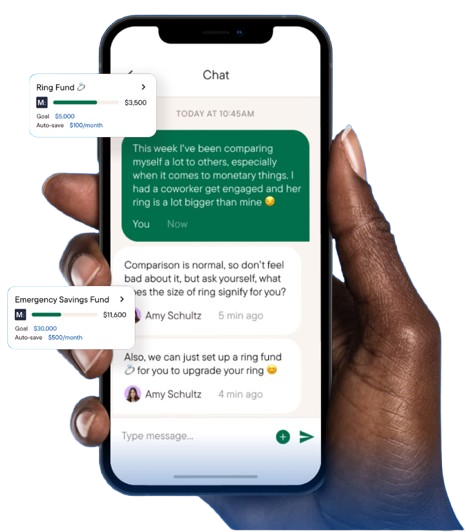

The future of relationship banking is seevah

We’re Your Secret Superpower

We provide thoughtful financial guidance and support so that your members become more confident financial citizens.

Increase Client Deposits

Personalized guidance, spending insights, and accountability helps consumers save more (Bolder members see an average savings increase of Rs.1,55,000 in 6 months)

Expand Product Sales

Relevant products and services recommended as part of guidance increase participation and trust (Bolder members open an average of 4 new financial products each)

Better Lending

Consistent guidance and accountability around cash flow and earnings means less risk of default for current loan borrowers, and a better prepared pipeline of borrowers

Capture Declined Pipeline

Build trust and develop healthy money habits with clients that don’t qualify for a product or loan, helping them improve their financial circumstances and product readiness

Revolutionizing relationship banking

We combine practical financial guidance with behavioral and emotional support to help members achieve their goals.

Check Illustration

More deposits, and profits.

Check Illustration

More engaged customers using more financial products.

Check Illustration

Acquire emerging, and underbanked customers.

Check Illustration

Retain customers, and compete against fintechs and neobanks.

Check Illustration

Real impact on community, and position your institution